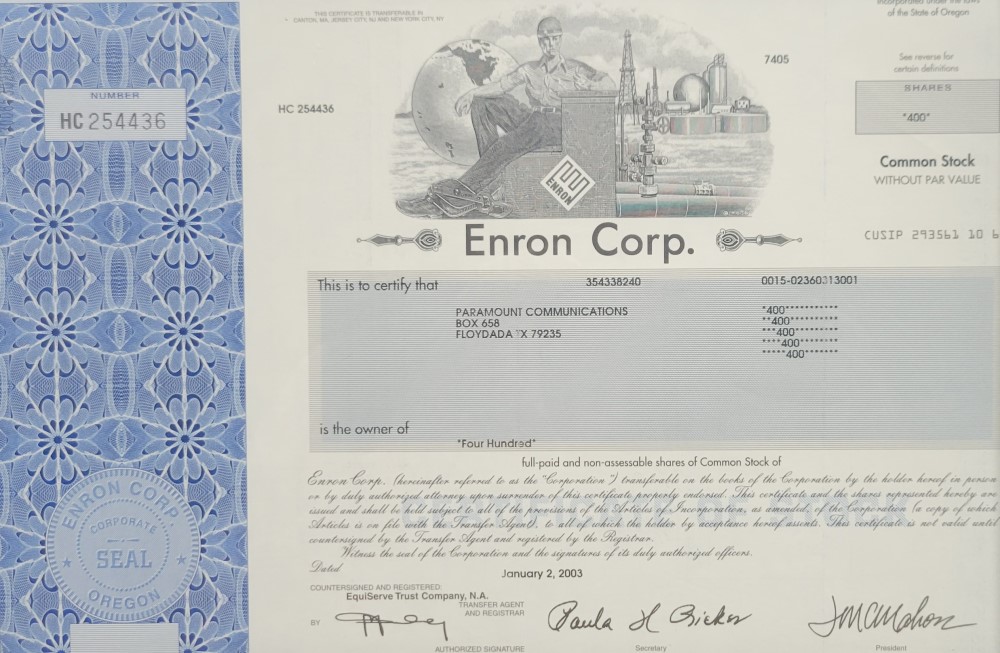

This Enron stock certificate was issued for $25 after the company filed for bankruptcy in December 2001. (FCR Photo)

Where were you 20 years ago today?

Though today’s date represents an 8-digit palindrome (12-02-2021) — where the numbers are the same forwards and backward — it’s actually the 20th anniversary of Enron’s filing for bankruptcy.

Enron was an energy, commodities, and services company based in Houston that Forbes had named “America’s Most Innovative Company” for six consecutive years prior to a revelation of institutionalized, systematic and creatively planned accounting fraud, known since as the Enron scandal.

At its peak in 2000, the company claimed revenues of nearly $101 billion and employed almost 30,000 people. However, on December 2, 2001, the company fell from grace as the accounting practices and activities of many corporations in the United States were brought into question, leading Congress to pass accounting reform known as the Sarbanes–Oxley Act of 2002.

Today, the only value for creditors and stockholders of the former giant is their story. Enron emerged from bankruptcy in 2004, but no longer exists except in the history books. The bankruptcy, at the time, was the largest in U.S. history but has been surpassed by Worldcom in 2002 and Lehman Brothers in 2008.

According to the Motley Fool website, the thing to recognize is that among investors, greed will always trump fear in aggregate, and there will be another Enron.

Heck, there will be plenty more. That’s why when Fool co-founder Tom Gardner and I scour the market for promising small caps each month (and) pay particular attention to the quality of the leadership teams at the companies we’re analyzing. Not only is quality of management among the top three things that we find in the best small-cap investments, but managers who care more about their company than their stock are also less likely to engage in Enron-type dishonesty.

To avoid the next Enron, protect yourself in advance. Simply avoid the situations where fraud is a possibility and invest in the situations where management is on your side.

So on this platinum anniversary of the fall of Enron, we find the value today is also a palindrome, $0.00. Of course, if you do get caught in another Enron-type situation, make sure you get a souvenir!

Editor’s Note: The stock certificate pictured here cost $25 in 2003 and represented a value of less than 1¢ at the time of issuance. The value today of the certificate is worth much more than in 2003, but far less than the value of the stock when originally purchased.