It is always nice to find a fund that you can buy, kick back and let the distributions reinvest (if you don’t need the money right away) and maybe add to your investment from time to time. I think Blackrock Health Sciences Trust is just that kind of fund.

Blackrock Health Sciences Trust (BME) is a closed-end fund that I have liked for a long time. It is a fund that holds mainly large-cap healthcare-related stocks. United Health Group, Johnson & Johnson, Pfizer, and AbbVie are some of the top holdings. The fund managers have done a good job of buying the right stocks and selling the right stocks through the years. They also use options to increase the income of the fund based on what they think is happening in the market as a whole. This fund was created in March of 2005, so it has been tested through the 2008 housing crisis and all the ups and downs of the market for 17 years.

At a recent price of $41.32, BME has an annual yield of 6.19%. They pay a monthly distribution of $0.213 per share, so you can have a monthly cash flow with this fund. The distribution is a combination of dividends, long-term capital gains, short-term capital gains, and return of capital. In 2021, the majority of the distribution came from long-term capital gains (which are taxed favorably).

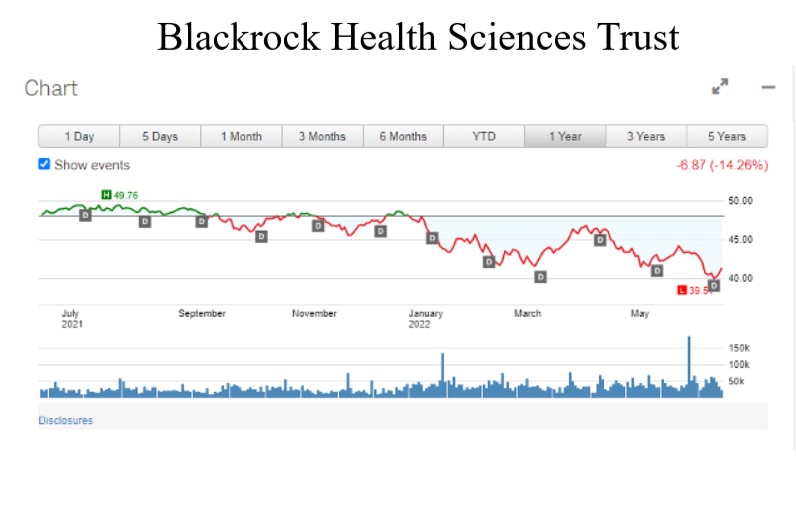

Morningstar currently gives BME a rating of 5 stars overall, with a historic return of “Above Average” and a historic risk of “Low”. Based on its market price, BME has had annual returns of -3.36%, 11.12%, and 14.38% for the last 1-year, 5-year, and 10-year time frames, respectively. Since it was formed in 2005, BME has averaged an annual return of 12.04%. BME has had a 52-week high of $49.76 and a 52- week low of $39.51. The market value has a slight premium (.62%) to its NAV (Net Asset Value – the value of the sum of its parts.) The 52-week average is a 1.05% premium.

BME is a good foundation for security in my opinion. It is usually slow to move and does not often make big daily swings in its market price. The stable nature of BME can give you some comfort when the markets are not behaving like you want them to. This is not to say the price of BME will not go down, it will. However, it seems slower to react than many individual stocks and won’t drop out from under you. BME is also not a stock that will just take off like the next Amazon either. It is a smoother ride, all the while paying you over 6% per year to hold on.

While it is always better to buy a fund trading at a discount, BME has a very low premium now, and the premium is currently below its yearly average. Healthcare is always in demand, and BME has found a way to give you the safety of stable, large-cap health companies along with a very generous 6.19% yield that is paid monthly.

Full disclosure, I own BME and think it would make a good addition to a more conservative, income-producing portfolio. As always, do your own due diligence before investing. Sources include Morningstar, Yahoo Finance, and Cefconnect.com.

(Intentional Investing is a weekly column written by Kyle Smith from Floyd County, TX, based upon his personal investment knowledge and does not represent the views or opinions of the Floyd County Record. You can reach Mr. Smith via email ksmith79235@gmail.com)