Qualcomm Inc (QCOM)

Qualcomm Inc (QCOM) is a picks and shovels type of company. Instead of providing cell phones to customers, they provide integrated circuits and system software for 3G/4G/5G and other technologies to provide voice and data transmission. Their technologies also help networking, apps, multimedia, and GPS work like they are supposed to. Qualcomm also makes money by granting licenses or rights to use parts of its technologies to ease the manufacture of wireless products. For the most part, if it has to do with cell phones or wireless communications, Qualcomm is involved.

Qualcomm is in the technology sector, of course, and like other tech companies, has been hit hard by the increase in interest rates. Because most tech companies rely on financing to carry out their operations and support research, the rising interest rates could make this part of the operation much more expensive, cutting into profits. As of September, Qualcomm has over $15.48 billion in debt. This had come down over the previous 3 years when it was $15.96 billion in 2019.

The sales of cell phones also have a huge impact on Qualcomm’s growth. With estimates of Apple’s sales wavering some going into the 4th quarter this year, this has affected the stock price of QCOM. Qualcomm’s 3-5 year EPS growth forecast is negative 7.47%. If cell phone sales can prove to be better than expected, I would also look for Qualcomm’s stock price to be better.

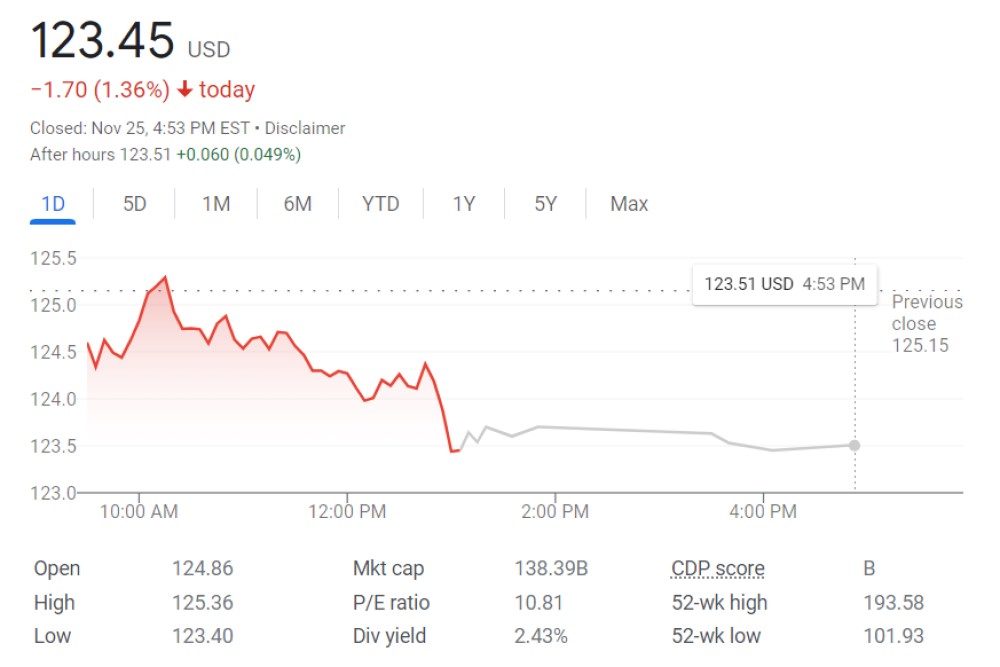

Qualcomm hit a 52-week low in early November, touching $101.93 per share, and has a 52-week high of $193.58. QCOM has bounced from the early November low to a current price of $123.45, so the easy money may already be made. Morningstar has a fair value estimate of $140.00 per share, so there is still some potential upside. Yahoo Finance has a 1-year price target of $149.84.

Qualcomm pays an annual dividend of $3.00 per share. This gives you a dividend yield of about 2.43%. While not a huge dividend yield, QCOM has increased its dividend yearly for the last 19 years. Over the last 10 years, Qualcomm has increased its dividend at a 10.6% clip. Qualcomm can become a strong contributor to a dividend income portfolio if it can keep up this increase in dividends paid.

If interest rates moderate and new cell phone sales increase, Qualcomm can easily reach its fair value of $140.00. If you want a larger margin of safety on this stock, wait until it drops into the mid-110s before jumping in.

As always, do your due diligence before buying any stock. Full disclosure: I own shares in Qualcomm Inc. Sources include Morningstar, Schwab, and Yahoo Finance.

(Intentional Investing is a weekly column written by Kyle Smith from Floyd County, TX, based upon his investment knowledge and does not represent the views or opinions of the Floyd County Record. You can reach Mr. Smith via email at insureddividends@gmail.com)