This week let’s look at a good dividend payer that carries a little more risk.

This week let’s look at a good dividend payer that carries a little more risk.

Based in the Cayman Islands, Patria Investments (PAX) is one of the leading investment firms in the world, offering a wide range of investment products and services. The firm boasts a long history of success in the financial markets, thanks to a strong team of experienced and knowledgeable professionals. Patria Investments focuses on alternative investments in Latin America. PAX is highly sought after by investors, as it is seen as a reliable way to gain exposure to a variety of market sectors, including commodities, real estate, and technology. Patria also offers a range of other services, including advisory services, private equity, venture capital, and hedge funds.

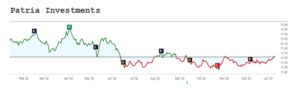

The stock price has had a wild ride, like most of the market in the last year. It hit a high of $19.20 in April 2022, and a low of $12.25 last October. It has recovered recently to $15.06. Patria pays a floating dividend based on their earnings. This can make it unattractive for investors needing steady income. However, with the dividends paid over the last year it has a trailing annual yield of 4.64%. Patria has a net profit margin of over 35% and a return on equity of 14.31% – both good numbers for an investment management company. It also sees growing its earnings over 26% during the next 3-5 years.

Patria should be realizing some income from its investment funds soon. They announced last week that one of their Infrastructure funds has reached a point that Patria will receive about $15 million in performance fees from the fund. So far, they have about $127 million of Net Accrued Performance Fees from this fund. Patria manages about $26.5 billion in assets as of September 30, 2022.

Patria is a popular investment among its peers. Blackstone owns about 14% of the company, and insiders (top executives, etc.) own about 60% of the company’s shares. With Patria’s investment funds coming to the point they can sell off and monetize parts of the fund, their earnings should increase over the next year. The trailing P/E ratio is 29.46, which is rather high. However, the forward-looking P/E ratio is only 7.94. This is based on the price divided by the expected earnings over the next year. Also, the PEG ratio is only 1.14, which is good (the lower the better and under 1.5 is considered inexpensive).

Watch PAX for a while and get comfortable with the price pattern of the stock. If you can stand some variation in the dividend and some volatility in the stock price, I think Patria can reward you for taking a risk. Yahoo Finance has a price target of $19.27 for PAX in the next year, about a 28% increase not including the dividend.

As always, do your own due diligence before investing. Full disclosure, I own shares of Patria Investments. Sources include Schwab and Yahoo Finance.

(Intentional Investing is a weekly column written by Kyle Smith from Floyd County, TX, based upon his investment knowledge and does not represent the views or opinions of the Floyd County Record. You can reach Mr. Smith via email at insureddividends@gmail.com)