Microsoft Corp (MSFT) needs no introduction. If you use a computer, you probably use a Microsoft product in one way or another. They mainly develop, license and support software. Windows, Office 365, Teams, Outlook, and Skype are some of the most popular software programs they produce. They have more recently developed a cloud platform known as Azure. And most recently, the buzz has been around their use of AI – artificial intelligence.

It is these last 2 items that have the interest of the investing world. Azure lets companies, large and small, work from anywhere as their programs are in the cloud and are accessible anywhere the workers are. Azure also lets workers in the office see the same thing that remote workers see and work on their projects at the same time. Azure is considered one of, if not the, major growth factor for Microsoft right now.

The other project that is gaining the spotlight is AI – artificial intelligence. With the recent investment in and eventual buyout of OpenAI and their product ChatGPT, Microsoft has made the first big leap into bringing AI to the masses. There needs to be some refinement, as with all new concepts, but AI can help workers do more routines faster and can think and learn from experiences. According to Statista, revenue from AI software is expected to reach $126 billion by 2025. Microsoft is using this technology in its Bing search engine to bring better results. While Google has the majority of the search business, Microsoft with its 3% market share has the chance to gain the most in the search category with this innovation.

Microsoft is also trying to buy the gaming software company Activision. With the hits that Microsoft has and the X-Box platform, Activision would be a real boost to this sector of Microsoft’s business. The general view is that the deal will go through, but it is being challenged by Sony (PlayStation) as well as several governments. We will have to wait to see how this plays out.

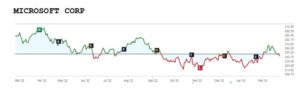

Microsoft’s share price has rebounded since its low last November. Trading at about $249, it hit a 52-week low of $213.43 and reached a high of $315.95 in March 2022. With a forward P/E ratio of 26.65 and an overall market P/E of about 20, Microsoft is considered expensive – but it always is. Their 5-year average P/E is 32.06, so they are less expensive right now by this metric. MSFT pays an annual dividend of $2.72 giving it a yield of 1.09%. While this is not a very high yield, they have grown their dividend by 11.7% annually over the last 10 years. Earnings are expected to grow at about 11.7% also for the next 5 years, so the dividend trend should follow.

Wedbush Securities just raised their price target for Microsoft to $290 per share from $280. Yahoo Finance has a $286.24 one-year price target. Recently, JP Morgan raised their target from $265 to $305 per share.

In my opinion, with the growth in Azure, the launch of ChatGPT in its search engine, and the probability that Activision comes into the Microsoft fold, Microsoft can be bought under $250 per share and you should do well long term.

As always, do your own due diligence before buying any investment. Full disclosure, I do own shares of Microsoft. References include Schwab, Yahoo Finance, Fidelity and Benzinga.

(Intentional Investing is a weekly column written by Kyle Smith from Floyd County, TX, based upon his investment knowledge and does not represent the views or opinions of the Floyd County Record)