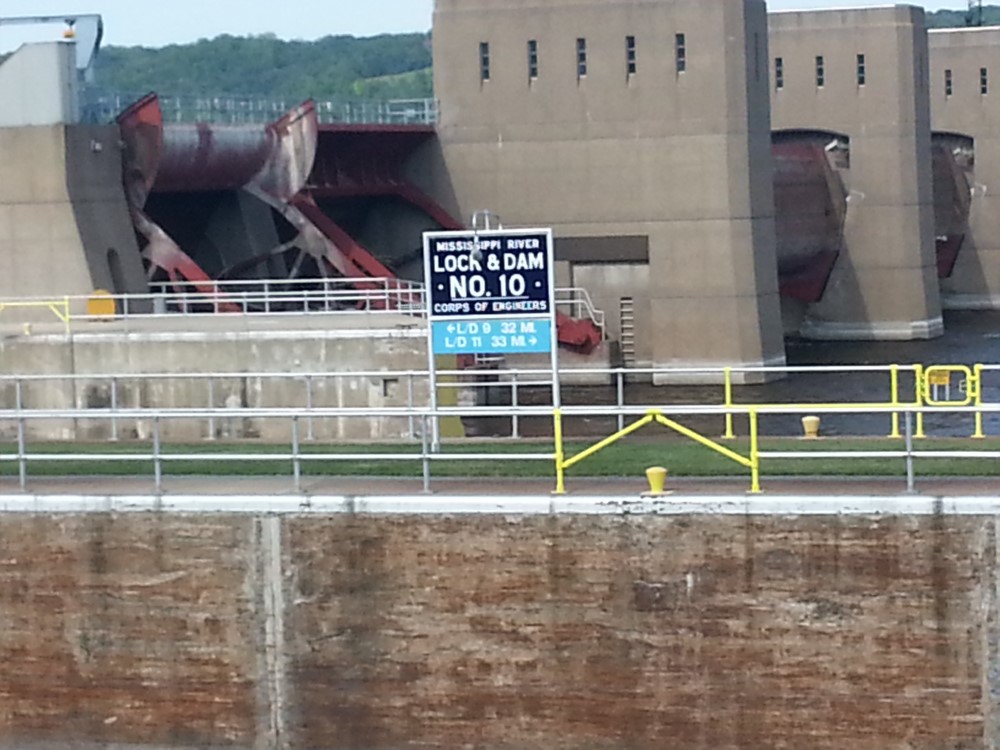

Locks and dams on the upper Mississippi River (Photo All Ag News)

China Trade Talks Continue, Agriculture Still A Priority

WASHINGTON, DC – U.S. and Chinese officials met in Stockholm last week to discuss extending the tariff pause set to expire August 12. According to the Wall Street Journal and Associated Press, both sides described the discussions as constructive, though no final agreement has been reached. President Trump must approve any extension.

Agriculture remains central to the negotiations. The United States is pushing for greater Chinese purchases of corn, soybeans, and other key commodities. In return, China is seeking concessions on U.S. export controls and clarity on industrial policies. Analysts say the talks may pave the way for a potential summit between President Trump and President Xi in the fall.

While no formal deal emerged, the continuation of talks signals a mutual interest in avoiding tariff escalation. A short-term extension would provide temporary relief for U.S. agricultural exporters, though major trade reforms remain unresolved.

(SOURCES: AP, Wall Street Journal, Euronews)

**********

India Trade Deal Delayed As Tariff Threat Looms

WASHINGTON, DC – Trade talks between the U.S. and India remain unresolved, with President Trump warning of 20–25% tariffs if no agreement is reached by August 1. U.S. Trade Representative Jamieson Greer says agriculture remains a sticking point, particularly India’s long-standing restrictions on genetically engineered (GE) soy products.

India has historically been self-sufficient in feed ingredients but temporarily allowed GE soybean meal imports during a 2021 poultry feed shortage. That policy change briefly tied Indian soybean prices to global markets, improving domestic feed access. According to USDA’s Economic Research Service, allowing GE imports permanently could benefit India’s poultry industry and reduce consumer prices.

India’s Commerce Minister Piyush Goyal has called the talks “fantastic,” but said core issues remain unresolved. Without a deal, U.S. agriculture exporters could face steep tariffs, while India risks limiting its animal protein sector.

(SOURCES: Reuters, Economic Times, USDA ERS, Times of India)

**********

New Loan Program Rates Set Through 2031 Farm Bill

NASHVILLE, TN – New Marketing Assistance Loan (MAL) rates were established under the “One Big Beautiful Bill” signed by President Trump on July 4. These loan rates, which support key commodities, will apply from the 2026 through 2031 crop years. Most MAL rates increased by 10%, except upland cotton, which rose by a variable amount depending on its previous pricing structure.

This change mirrors earlier proposals from the House Agriculture Committee and provides farmers with more financial certainty for marketing decisions. The MAL program allows producers to use their stored crops as collateral for operating loans. It is designed to support cash flow after harvest while allowing for delayed marketing.

For upland cotton, the new flat rate is $0.55/lb—up from the effective floor of $0.52/lb under the 2018 Farm Bill. USDA’s Farm Service Agency has released updated guidance to help producers evaluate the program’s benefits.

Farmers are encouraged to consider MAL as part of a comprehensive risk and marketing strategy, especially as interest rates and input costs remain elevated.

**********

BNSF Corn Rail Tariffs Shift for New Season

NASHVILLE, TN – BNSF Railway is adjusting corn rail tariff rates for the 2025/26 marketing year, cutting rates to Hereford, Texas, while keeping rates to Pacific Northwest (PNW) export terminals unchanged. The changes affect BNSF’s shuttle program, which moves 110–120 car trains of grain under contract. Corn has been the top rail-hauled grain commodity, and BNSF leads in carloads.

For most elevators on BNSF’s network, rates to Hereford will decline. For example, the rate from St. Joseph, Missouri, will fall by $600 per car, a drop of about 15 cents per bushel. In contrast, PNW rates will remain flat. The resulting “PNW-Hereford tariff spread” is a key metric guiding corn flows. Elevators in South Dakota and Minnesota may now favor PNW, while those in Iowa and Nebraska may favor Hereford.

Corn delivered prices will ultimately influence flows more than tariffs alone. USDA projects a record 15.7 billion bushels of U.S. corn production in 2025/26. With large acreage increases in the Dakotas, corn from those states may flow west to the PNW. The new rates take effect in October and reflect growing efforts to optimize rail efficiency.

**********

Peanut Stocks Grow, But Edible Utilization Slips

NASHVILLE, TN – USDA’s latest Peanut Stocks and Processing report shows commercial peanut stocks reached 2.17 billion pounds as of June 30, 2025—up from 1.94 billion pounds a year ago. That includes 1.45 billion pounds of farmer stock.

Shelled peanuts on hand totaled 503 million pounds, including 476 million pounds of edible grades and 27.1 million pounds for oil use. Runner-type peanuts made up the majority of edible stocks at 376 million pounds.

June millings totaled 405 million pounds, led by Runners at 337 million. Utilization of shelled edible peanuts for the month hit 193 million pounds, including 113 million for peanut butter, 40.2 million for candy, and 36.1 million for snacks.

Despite strong stocks, edible grade utilization for the season is down 1 percent from last year. Meanwhile, the price received by farmers averaged 26.2 cents per pound for the week ending July 19.

**********

California Peach Forecast Points to Higher Production in 2025

NASHVILLE, TN – California remains the nation’s top peach-producing state, and USDA’s May Crop Production forecast shows a 4 percent increase in total peach output for 2025. Production is expected to hit 550,000 tons—11 percent above the previous three-year average.

Freestone varieties continue to lead production, with 320,000 tons forecasted, compared to 230,000 tons of clingstones. If realized, it would mark the sixth consecutive year that freestones have outpaced clingstone peaches.

Clingstones, primarily used for processed products like canned and frozen peaches, have seen bearing acreage shrink from a 2004 peak of 32,000 acres to under 14,000 in 2024. Freestone acreage, mainly for the fresh market, has ticked upward slightly since 2017.

As of mid-July, deliveries to processors were up 36 percent from the same time last year, totaling 13,600 tons—about 6 percent of the season’s expected volume. The California Canning Peach Association was still finalizing a base-price agreement with one of the industry’s major processors.

Meanwhile, U.S. canned peach imports have risen steadily over the past two decades. Imports now represent over 30 percent of domestic supply, up from less than 10 percent in the 1990s. More than 80 percent of those imports come from China and Greece.

Fresh-market peach harvest is underway in California and winding down in South Carolina and Georgia. Despite early-season shipment lags, prices are in line with last year. South Carolina’s crop is facing disease pressure due to humid weather, while Georgia’s peaches are in mostly good-to-excellent condition.