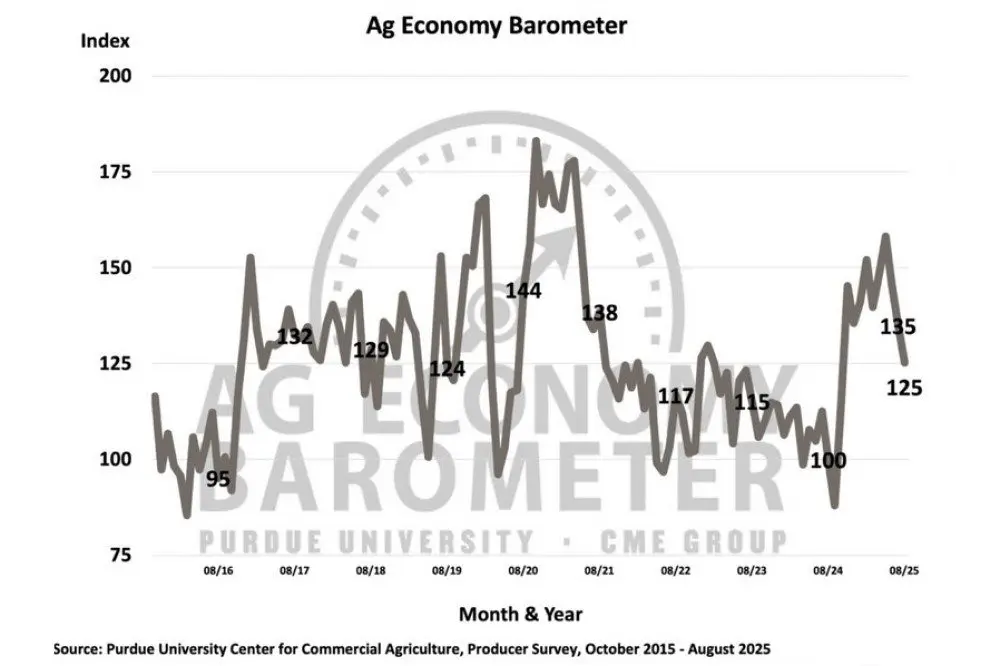

Farmer Sentiment Weakens As Crop Prices Pressure Confidence

WEST LAFAYETTE, IN – Farmer sentiment declined in August as the Purdue University–CME Group Ag Economy Barometer dropped 10 points to a reading of 125. The decline was led by weaker expectations about the future, with the Index of Future Expectations falling 16 points to 123—its lowest level since September 2024. Current conditions remained steady, with a reading of 129, unchanged from July’s 127.

Crop producers expressed notably more pessimism than livestock producers, reflecting the profitability gap between sectors. USDA’s August forecasts for the 2025/26 marketing year pegged corn prices at $3.90 per bushel and soybeans at $10.10 per bushel, both well below breakeven levels for many operations. In contrast, beef cattle producers continue to benefit from record prices supported by the smallest U.S. cattle inventory since 1951.

The Farm Financial Performance Index held at 91, its second straight month below 100, highlighting widespread expectations of weaker incomes ahead. Despite this, the Farm Capital Investment Index rose 8 points to 61, buoyed by stronger optimism among livestock producers.

Concerns about credit conditions also surfaced. Twenty-two percent of farmers expect to take larger operating loans in 2026, with nearly a quarter of those citing the need to roll over unpaid 2025 debt. That figure represents a significant increase compared to similar surveys conducted in 2023 and 2024, indicating a rise in financial stress among crop producers.

Farm-Level Takeaway: Crop farmers are increasingly cautious as low commodity prices and higher operating loan needs point to tighter margins. Livestock operations remain in a stronger financial position; however, overall producer confidence suggests continued financial stress across much of the production agriculture sector.

**********

Soybean Crushing Rises In July, Canola Mixed

NASHVILLE, TN – U.S. oilseed processors increased soybean crushings in July while canola results were more uneven. According to the USDA National Agricultural Statistics Service, soybean crush totaled 6.14 million tons, equal to 205 million bushels. That was up from 197 million bushels in June and 193 million bushels a year earlier. The higher crush yielded 2.43 billion pounds of crude soybean oil, up 4 percent from June and 6 percent above the level of last July. Production of once-refined soybean oil reached 1.83 billion pounds, slightly higher than June but 3 percent lower than a year earlier.

Canola processing showed a different trend. Crushings totaled 209,848 tons in July, up from 166,486 tons in June, but below the 230,516 tons recorded in July 2022. The result was 164 million pounds of crude canola oil, a 25 percent increase from June but still 10 percent lower than last year. Once-refined canola oil production hit 175 million pounds, improving from June but down 1 percent year over year.

Farm-Level Takeaway: Stronger soybean crushing supports consistent demand for beans and soybean oil, while canola processors continue to adjust to tighter supplies and variable markets.

**********

Machinery Costs Rise Modestly In 2025 Update

URBANA, IL – Machinery costs for 2025 have been released by FarmDoc, showing modest increases compared to the sharp jumps seen two years ago. According to University of Illinois and Ohio State University economists, most machinery cost categories are up between 1 and 14 percent since 2023, a much smaller climb than the 30 percent spikes reported between 2021 and 2023.

For example, the hourly cost of operating a 310-horsepower tractor rose 3 percent over two years, from $249.10 in 2023 to $255.80 in 2025. Rising list prices for machinery, which increased 7.5 percent for that tractor size, pushed overhead costs higher. However, lower diesel fuel prices helped offset part of the increase, dropping per-hour fuel costs from $52.50 in 2023 to $44.80 in 2025. Labor costs rose slightly to $24.20 per hour.

Custom operators and farmers often use these estimates when setting rates for fieldwork, harvest, and forage operations. Analysts note that while machinery expenses continue trending upward, the slower pace since 2023 offers some relief compared to recent years.

Farm-Level Takeaway: Farmers face continued but smaller increases in machinery operating costs, with lower fuel prices easing the pressure. Planning with updated cost benchmarks can help in setting custom rates and managing overhead effectively.

Read more here: https://farmdocdaily.illinois.edu/2025/09/machinery-cost-estimates-for-2025.html.

**********

USDA Data Shows Cotton Consumption Down As Synthetics Rise

LUBBOCK, TX – USDA’s Cotton System Consumption and Stocks report for July 2025 shows sharp declines in domestic cotton use. Mills consumed about 273 bales of extra-long staple cotton, down 14 percent from June and 81 percent from July 2024. Stocks on hand at mills stood at roughly 583 bales, a 42 percent year-over-year decline.

In contrast, man-made fiber use was 20.3 million pounds, equivalent to approximately 42,292 cotton bales — a stark comparison that highlights the growing shift toward synthetics. Polyester staple accounted for 94 percent of man-made fiber consumed in July. Meanwhile, active spindles running 100 percent cotton were down 35 percent from last year, reflecting weaker mill demand for U.S. cotton.

Private cotton storage also continued its slide, with 63,657 bales on hand in July 2025. That’s down from 159,889 bales in 2024 and 345,659 bales in 2023, highlighting tighter U.S. stock positions.

Farm-Level Takeaway: Cotton’s share of mill consumption continues to shrink relative to synthetics, while private storage stocks have fallen sharply. For U.S. cotton growers, this suggests an even greater reliance on export demand to support cotton prices.