Cohen and Steers Infrastructure Fund (UTF) is similar to the fund we highlighted last week, the Reeves Utility Income Fund (UTG). They are often considered sister funds, even though they are managed by different investment firms. UTF has the objective to achieve total return, with an emphasis on income. They invest in assets issued by infrastructure companies, such as utilities, pipelines, toll roads, airports, shipping ports, etc. This sounds like UTG. However, at the time of writing, UTF is trading at a 0.9% discount to its net asset value (NAV) and yields 7.71%. It has traded at an average of .06% premium over the last year, going as high as a 4% premium and as low as a 5.09% discount to NAV.

Cohen and Steers Infrastructure Fund (UTF) is similar to the fund we highlighted last week, the Reeves Utility Income Fund (UTG). They are often considered sister funds, even though they are managed by different investment firms. UTF has the objective to achieve total return, with an emphasis on income. They invest in assets issued by infrastructure companies, such as utilities, pipelines, toll roads, airports, shipping ports, etc. This sounds like UTG. However, at the time of writing, UTF is trading at a 0.9% discount to its net asset value (NAV) and yields 7.71%. It has traded at an average of .06% premium over the last year, going as high as a 4% premium and as low as a 5.09% discount to NAV.

Some of the top holdings for UTF include NextEra Energy, Enbridge, American Tower Corp, Duke Energy, and Norfolk Southern Railroad. This Cohen and Steers fund has international exposure, so is not limited to companies just in the U.S. If the dollar weakens compared to other currencies, this could be a boost to those international companies. While still heavily focused on utilities, UTF can reach into other types of infrastructure companies to accomplish its goals of income and capital gains.

UTF is down 6.29% this year. While we do not want our investments to be down, this is better than the overall market, which is down over 14%. Over the 5- and 10-year periods, UTF is up 9.62% and 11.83% respectively. So, positive long-term results while paying you over 7% per year. UTF pays a monthly dividend of $0.155. Like UTG, this monthly dividend can be reinvested to compound your return or be used to pay monthly bills.

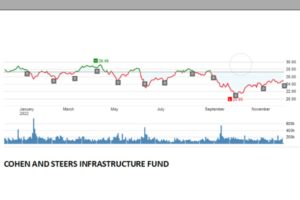

Cohen and Steers does use debt to enhance the return of this fund. UTF has about 29% of leverage which can enhance returns but can also be a drag because of higher interest expenses when interest rates are going up. If you can stand a little more risk this fund has rewarded you over the long term with good income and returns. The fund’s price has moved quite a bit over the last year. It has a 52-week high of $29.49 back in April and a 52-week low of $20.90 as recently as October. UTF’s price sits at $24.12 as this is written so it has rebounded off the low pretty well. I like this fund here, and like it even more if it drops into the under $23 range – which is possible. If you are patient, an 8% dividend yield could present itself over the next several months.

As always, do your own due diligence. Full disclosure, I do own shares in Cohen and Steers Infrastructure Fund. Sources include Schwab, Fidelity, and CEFconnect.

(Intentional Investing is a weekly column written by Kyle Smith from Floyd County, TX, based upon his investment knowledge and does not represent the views or opinions of the Floyd County Record. You can reach Mr. Smith via email at insureddividends@gmail.com)

===============================